Finance isn’t usually my favourite subject. Checking my bank balance usually requires a glass and a half of wine and crossed fingers. You see, I love to shop…and I have a bit of a denial issue when using my debit card. It’s not real money if you’re not handing over cash, right?

Finance isn’t usually my favourite subject. Checking my bank balance usually requires a glass and a half of wine and crossed fingers. You see, I love to shop…and I have a bit of a denial issue when using my debit card. It’s not real money if you’re not handing over cash, right?

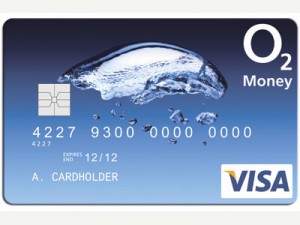

At the ripe old age of 24, it’s time I learnt how to set a budget and stick to it. Which brings me to the newest addition to my purse. My O2 Cash Manager card.

I got the card a few weeks back, after my accountant warned me that putting dinner at Nandos on my debit card didn’t look so good for my tax return. I’m notoriously rubbish at remembering to take cash out, so I was pretty happy to hear about the O2 Cash Manager card, a pre-paid debit card.

Free to anyone already on an O2 contract, the Visa card allows you to top it up with up to £10,000 a year, and then use it as you would a normal debit card. For me, this card has three main benefits:

- I can add however much I want to spend, allowing me to set a budget

- It won’t let me spent more than is on the card, so no accidental overdraft usage.

- It texts me every time I spend money, telling me how much I’ve spent, how much is left on the card and where I spent it. I can’t really avoid my balance when it’s sitting in my inbox.

The text alert is my favourite feature, and really does make me stop and think before I splash out on another pair of black shoes or a pair of vibrating hair straighteners.

It’s simple enough to top up too. You can set up a direct debit to top it up the same amount each month, or just top it up as you go. There’s a second card, the Load and Go, which allows you to top up to £1,800 a year and can be topped up using any of the top up points across the UK.

The only downside is that I’ve had to change my details for various sites like PayPal. Irritating, but worth it if I actually stick to a budget.

Money is Time: Watch2Pay contactless payment watches

Money is Time: Watch2Pay contactless payment watches Eton’s Solar iPod Speakers

Eton’s Solar iPod Speakers Babyzen YOYO – a carry-on buggy that comes with lashings of smug

Babyzen YOYO – a carry-on buggy that comes with lashings of smug RSS

RSS

This was like the Smart Cards we had at university in place of Student ID cards. They were great – load them up with money and you could buy your food and books etc on campus with them. The only downside was that if you lost one that had money on, you lost the money.